5 basic personal finance tips that everyone should know

Pete Zimmerman | 10/18/2022

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 5 minutes

Summary: Personal finance can get complicated, but deep down, there are a few basic principles that create the foundation for everything else. Think of these as the footing of an 800 ft skyscraper. You see the sparkling glass, modern architecture, and flashy corporate logos, but none of it could be there without the solid concrete and steel underpinnings. These simple, straightforward pieces of wisdom can take you a long way and are all the knowledge that you need to be successful with your money. Start building your own money foundation with these five tips.

Personal finance doesn't have to be complex

Always look both ways before you cross the street. Don’t ever take candy from strangers. Don’t stare at the sun, son. Every parent throws this wisdom at their children. It’s basic stuff, but it’s also important when you’re a kid just venturing out into the world.

The innocence doesn’t last though. You aren’t Peter Pan—forever soaring around Neverland without a care in the world—and soon you’re exposed to a flood of other issues like health, relationships, work, and just managing your expanding life. But there are a few principles perched at the top in those facets too: eat right, exercise, treat others how you’d want to be treated, and work hard to get rewarded. You know the drill, right?

The same thing applies to personal finance – the worry and distress that lives inside this radioactive topic could be put to bed with some basic advice. But since it’s also a topic that – apparently – no parent or educator knows, likes, or cares to talk about, ever, there’s a giant empty hole where financial literacy should be.

Want to fix that hole with some simple, straightforward wisdom?

Good. We’re going to cover five basic concepts that will get you rolling and jumpstart your transformation from a would-be sucker to a street-smart, tough advocate for yourself and your financial future. Here's tip number one.

Tip 1: Money now is better than money later

What’s the most obvious way that money gets measured? That’s easy, “how much”, right? A first-grader can tell you that a $10 bill is worth more than a $5. Would it surprise you to learn that there’s another measurement that’s equally important?

There is: “when”.

Often, the toughest financial concept to grasp is that the value of money isn’t just the number printed on the bill, but also when you get that bill. Does that sound vague and abstract at first? Maybe, but you experience this all the time.

Your pay comes in arrears, every week or two

Your tax return doesn’t come now, it comes sometime next Spring

Your bills come due on specific days each month

Money is always attached to a point in time.

And that point in time matters, because money now is always more valuable than money you might get later. Why is that? Because cash in your hand today is money you can invest or put to use earning more money, versus wringing your empty hands waiting for the tomorrow money to show up. Interest and earning potential are the secret sauce for making that time work for you, but you need the money in-hand to take advantage. A promise for the future won’t cut it.

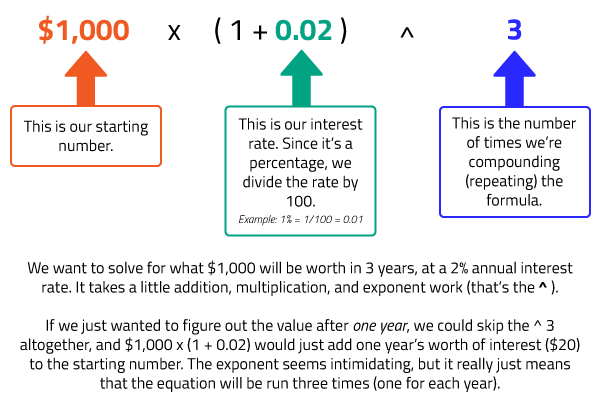

To illustrate, let’s go over a simple example comparing money today against money in three years. Let’s say interest rates are at 2%, meaning that you can put your money in a bank CD, and get paid 2% per year on it. I give you two options: A: $1,000 now, or B: $1,050 to be paid three years from now. Which would you take?

We know already that Option B is worth $1,050 in three years (because that’s when we get it). But what will Option A be worth three years from now, if you get it today? Annoyingly, we’ll need to do some math to figure it out, but here it is.

Option A it is. We already knew it intuitively, but there’s the proof. Fancy finance types call this the “time value of money”. But all that really means is that (broken record) money now is better than money later, depending on what you can earn with it. If you have the choice, you know which to pick and why. If you aren’t sure, you can always check out Cashbasic's Time Value Calculator.

Tip 2: Focus on the long game

The best time to plant a tree is ten years ago. The second-best time is now.

The problems of the moment may seem like the most important thing in the world, but dealing with money is not short-term. Personal finance is a lifelong journey, and the sooner you start treating it that way, the better off you’ll be. Focusing on the future (called “prospection”) gives you the opportunity to prepare yourself, weigh options, and make informed decisions rather than just being a passenger, along for the ride in your own life. Studies actually show that feeling closer to your future self can help you make more prudent decisions now.

You may have your eye on a $50 pair of shoes, but your future self would almost certainly prefer that you save the money. Those decisions snowball, and if you keep delaying saving because you aren’t focused on the longer-term, it could be years of wasted potential. $50 saved per month over five years’ time is $3,000 for your future self.

The same goes for ensuring that you are earning what you are worth at your job, or working towards training, networking, or promotion opportunities that get you there as soon as possible. Earning more money now will benefit you for years. If you make $25,000 a year, landing a 5% raise now will earn you an extra $6,250 over five years. 5% seems like a small number, but over the long term, it’s life-changing money for most people.

To stay in a long-term mindset, always ask: am I doing things that will help me to be better off in 5 or 10 years? Or will I look back and wish I had done more to help my future self? Remember, you can’t get those years back. So avoid the big money mistakes, don’t sweat the small stuff, and focus on where you want to be instead of where you are now.

Tip 3: Get your money to work for you (and not against you)

Seems backwards, doesn’t it? Don’t you work for money, not the other way around? Yes, but it doesn’t have to be that way. Money making money seems foreign at first, but it’s the golden ticket to long-term financial security. In fact, this is the #1 hack that the rich have used for eternity to continue to get richer.

Warren Buffett may pretend to be an ordinary old man, but back in 2017, he was allegedly earning $6,700 … per minute, while he sits there eating ice cream at Dairy Queen. At $24,000 a year, you or I would be making about $1 a minute. Rest assured that Warren isn’t running to 6,700 jobs to earn it. ALL of that income is being generated, not by toiling away at work, but by his existing money working for him. The money he’s paying for that sundae at DQ is coming out of one pocket and going into another (along with every other customer…)

Sure, this is an extreme example, but it IS real. And you don’t have to earn $6,700 a minute in passive income to get started on something. Just start small, with something that works for you and your personal situation.

If you haven’t already done it, the #1, highest-impact thing you can do now is to throw off your debt chains. Easier said than done? True, but if you have high interest (15%+), bad debt, it’ll continue to choke you and stunt your financial progress for as long as you let it hang around. As we talked about earlier, accumulating more money will make money, but there’s no sense in renovating your house while half of it is a blazing inferno. Get rid of the debt.

After that, think through a way (or ways) to make your money your employee and put it to work for you. Invest it. Put your savings in an account that earns interest. If your employer offers a retirement plan, take advantage of it (especially the employer match)! Use credit card rewards to earn free money on money you’re going to spend anyway (just be sure to pay off the balance in full each month). Stand up a small side gig based on a hobby or an interest that you’re already good at. Get creative!

Most importantly, switch your mindset from one of consuming to one of producing for yourself. And again, just start small. You might be surprised at the opportunities that pop up when you open your mind and think bigger.

Tip 4: Keep records

What am I doing here?

Have you ever walked into a room, and then completely forgotten what you came there for? You aren’t alone. Actually, it’s so common that there’s a name for it: "The Doorway Effect" . What’s the solution? Never leave your room, obviously. Joking aside, a lot of things get forgotten, and that goes for decisions and behaviors around your money too. How much did you spend last month on non-required (voluntary) expenses? How about last week? Yesterday? …Today?

* crickets *

Of course you probably don’t know. Life is too busy to remember the fleeting details. That’s why one of the most important skills to master in personal finance is good record keeping. If you can’t keep track of your money, where it goes, where it comes from, and how much you have before you spend and make decisions, you will never be able to manage it properly.

This is one of the top reasons that developing a personal budget is so important: not even because of the direct financial benefits, but because it forces you to pay attention and document things that you’d otherwise forget. You don’t even need to create formal budget. The critical thing is to build a system that works for you and makes it simple and routine to track your money and keep an eye on what’s happening in your bank account.

Tip 5: Develop goals and plans for yourself

If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.

- Jim Rohn

There’s a great quote from the late self-help expert and motivational speaker Jim Rohn: “If you don’t design your own life plan, chances are you’ll fall into someone else’s plan. And guess what they have planned for you? Not much.”

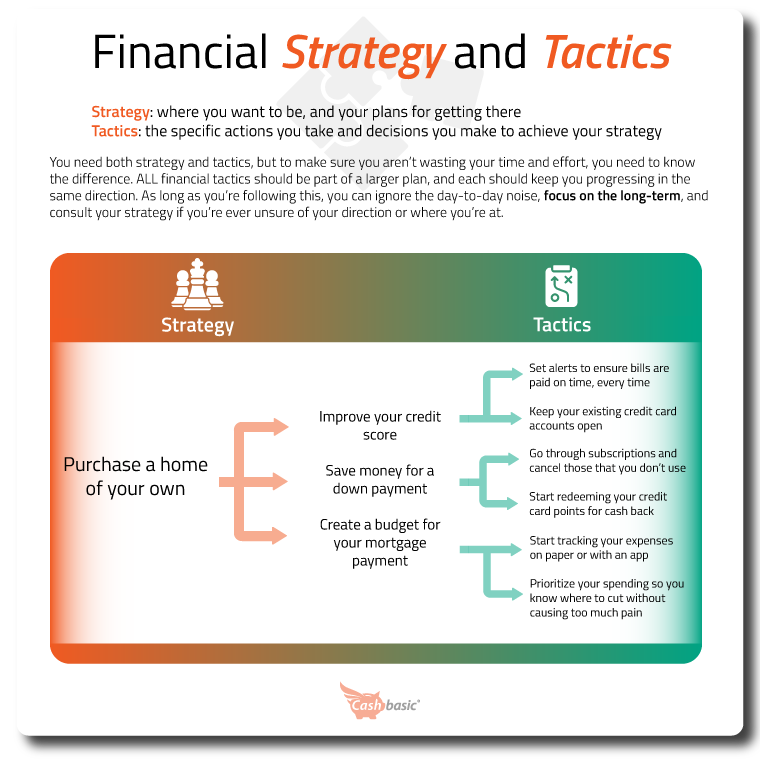

People tend to spend more time planning what they’re going to have for lunch than planning their week (or even their day). This is a small but real example of focusing on tactics over strategy. Tactics are gratifying, because they’re concrete – you get feedback now and can see real results quickly. Who doesn’t like checking something off your to-do list? It’s a great feeling. On the other hand, strategy isn’t fun for most people. Say you want to save $10,000 for a down payment on a new house by setting aside $100 per month. That’s a solid strategy for purchasing a home, but it’s not particularly rewarding – you may not even know if you’re successful until many years later. Strategy sucks to deal with and feels like work with no payoff, but it’s INFINITELY more important than short term tactics. The payoff is just in the future.

This is why planning and setting goals are so important. They chart your path so you can always be sure that your actions and decisions are pulling you in the same direction. What do you want your life to look like in 2 years? 5 years? 10 years? Do you want a newer, more reliable car? How does that fit into your plans to save money for an emergency fund? How do each of these priorities interact with saving for a down payment on a house? These are all strategic questions, and they require planning and goal setting on your part. Informally, at least.

The most important thing, again, is to shift your thinking. Think of the long-term implications of your decisions and your habits. Develop basic plans, so at minimum, you are following your own path, instead of being distracted by the noise and chaos of today, or worse, by someone else’s problems seeping into your life.

Learn about yourself so you can learn the best way to set goals - check out the Money Persona Quiz for free

Ready to get started? The time is now.

This is a small sample from a large, complex topic, but you have to start somewhere. And despite the challenges, personal finance doesn’t have to be scary or even difficult. You just need to know what you are getting into, get your mind in the game, and start practicing good money habits. The sooner you learn, the sooner you can start changing your life for the better.

Video coming soon...

Share this post

There are no comments yet.

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.