How to make a budget

Pete Zimmerman | 11/1/2022

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 12 minutes

Summary: Budgeting isn't anyone's favorite pastime. You won't find it at the top of most people's weekend plans. But if you struggle to manage your money, have issues with spending, or just feel hopelessly lost when it comes to your money, nothing else comes close to giving you the financial clarity and control that a budget provides. There are dozens of budgeting strategies, and each of them takes work to design and build. But if you cut through the noise to what really matters, you can learn how to make a budget and get it up and running with a few simple steps. And most importantly, if you choose a budget style that truly fits your life and personality, you'll actually stick to it also.

It's up to you

If you asked any working-class person what their biggest worries were, money would almost certainly be near the top of the list. 26% of Americans are convinced that their money situation is going to deteriorate over the next year. Lower-income people watch as their savings efforts collapse before their eyes. These are grim situations that can easily snowball into financial catastrophes.

There are probably lots of reasons behind them. You can blame the pandemic, or inflation, or low wages, or cheapskate tippers. But guess what? No one's listening. And no one is coming to your rescue with a cape and a bag bursting with $100 bills. The truth is that if you have money problems that need to be solved, it's up to you.

Maybe you've you tried and failed at keeping track of your spending or budgeting. You aren't alone. Almost 3 out of 4 people say they have a budget, but 80% of people also freely admit that they don't stick to it. That's pretty pointless. Maybe you want to live a simple, financially secure life and so you dutifully punch the clock every day, but your bills are relentless and you still feel like you're slowly drowning. What gives? Why can't you get ahead?

Financial problems aren't just about money

It could be that you're just lazy and don't care. But if you're taking the time to read this, then you're probably also not lounging on the couch 8 hours a day, binge-shopping on Amazon with Cheeto-stained fingers. If that were you, you'd just hum along oblivious until you careen over the financial cliff.

The truth is more complicated — it turns out that you probably can't get ahead because financial problems aren't just about money. Are you incredulous? Would it shock you to hear that almost half of people earning over $100K a year are still living paycheck to paycheck?

Still not convinced?

Then how much would it take to actually be secure? A million dollars? Two million?

Nick Cage would tell you that isn't enough. He went bankrupt. So would Will Smith, who had 70% of his wages for Fresh Prince of Bel Air garnished by the IRS due to mismanagement and out of control spending. Because again, the issue isn't money — it's actually financial BALANCE.

Let's dive into that first.

What's a budget?

How do you get financial balance? You do it by harmonizing what you spend with what you earn. Usually, the absolute best way to do that is with a budget. Probably not what you wanted to hear? Hoping for a magic bullet instead?

Well, don't sweat it, budgeting isn't a bad word and shouldn't be intimidating. It's just a strategy. A strategy that you can use to break down, understand, and ultimately CONTROL your spending and financial life. It's no more complicated than that.

That strategy could be stacked full of strict guidelines, covering every scenario and detail. But it could also be a simple set of rules to help you with your spending decisions. Or just a way to divide your money in a thoughtful and useful way. What works for you will depend on your personality and your goals. And most importantly, what you will stick to. A dentist will tell you that using a water pick isn't as effective as flossing. But he'll also concede that the choice often isn't between a water pick and flossing (aka gum murder). It's really between a water pick and nothing.

The best method is the one that YOU WILL DO. For a budget, that means the method that you'll use to make prudent decisions about where your money gets spent and where it doesn't.

A tool versus a budget

Let's clear the air on something important.

Mint is not a budget. A Google spreadsheet crammed with numbers and formulas isn't a budget. Even your organized array of paper envelopes holding cash for different spending categories … you guessed it … is not a budget. Each of these things are actually tools. Focusing on just the superficial blinds you to the much more complex reality. Think of it like a journal or a diary. The book and pages are just paper and glue. What counts is what's behind it, what it means, and the personal actions and convictions behind the words. Your crush Johnny or Jeanie isn't just six letters written on a page, surrounded by tacky hearts.

The truth is lurking beneath the surface.

A budget is a living, breathing guide to your money. It doesn't exist on paper or on your smartphone — it lives in your head and your heart. The tool is how you stay organized, but the mental framework, personal discipline, and actual actions of budgeting dwarf any physical side of it.

Here are the factors that truly make up your budget:

The tool (organization and keeping records)

Mindset

Habits

Commitment

Goals

Priorities

Motive (your "why")

There are countless tools out there that you can use to track: various apps, online tools, spreadsheets, or even just pen and paper if that's your thing (or if you're 70). All of these options can help you stay organized, and that's the only requirement for the tool itself. The rest is a little more challenging.

Why Do I Need a Budget?

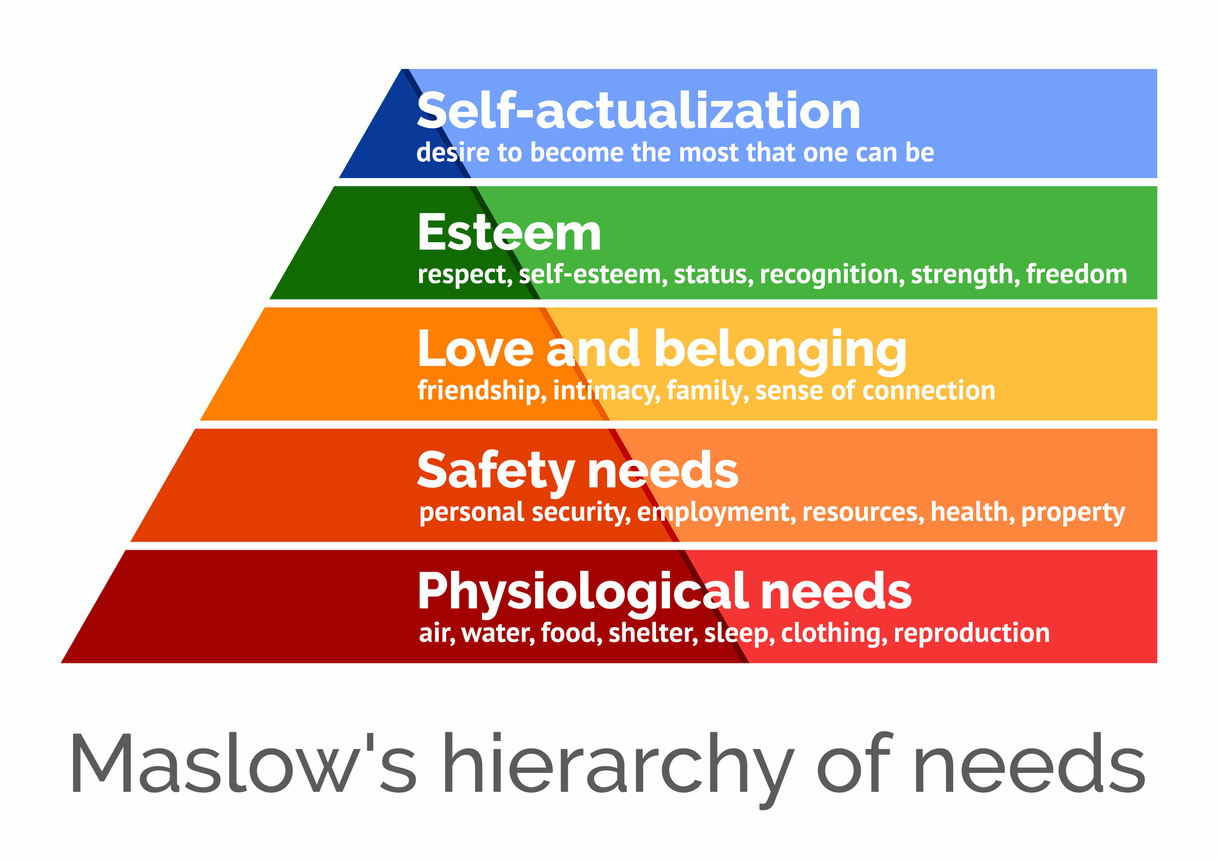

You may not “need” a budget like you need air. But in a society where — let's face it — money is a requirement to sustain yourself, you could argue that it sits above most other things that people think they need. There's this psychological theory called Maslow's Hierarchy of Needs. In a nutshell, it lays out the things that you need to have secured, before you can move up to the next “level” in your attainment of happiness and self-actualization. Or to put it simply, you can't start your presidential campaign if you're living in a dumpster.

A budget seems peripheral ... a sideshow when compared to other priorities in life. But the reality is that you aren't out there hunting and gathering, and building thatch huts to stay dry. Think about it — how many things on the lowest (most basic needs) level of this pyramid do you go out and find or grow yourself? Not many if any. You get what you need with MONEY. And a budget is the director of your money. It's the brains behind it.

So yes, a budget is important. It's important for helping you make informed decisions and planning for the future. It's important to make sure you're being true to yourself and ambitions.

Here are a few more reasons to think about, which you can also check out in detail in this article:

You owe it to yourself

It will prevent you from going broke

Not budgeting costs you TIME as well as money

Budgeting helps you take control of your money and your life

It helps you get what you want

It helps you prioritize and be more deliberate about your life

A budget isn't just about managing finances, it's also about managing time, resources, and emotions. It allows you to be more efficient with your limited time by putting a laser focus on what matters most.

How to Make a Budget in 5 Easy Steps

Does the thought of making a budget seem like standing at the foot of a mountain, neck craned, staring at the summit hidden in the clouds? Yikes…how much work is this going to be?

Thankfully, when you break things down, it isn't difficult. It's going to take some time, but like any large task (and anything that's worth doing), when you learn how to make a budget and chip away with small, gradual steps, you'll make progress much faster than you expected.

In fact, five simple steps will get you there. The first two are income and spending. The path of least resistance is to break down these down monthly, since that aligns with typical due dates on bills and pay periods usually multiply in evenly. So go with the flow. No need to paddle upstream when you already have work ahead of you.

Step 1: Determine Your Income

Step 1 is to catalog how much money you're bringing in each month. This should include all sources of income, including wages, salary, tips, routine investment dividends or interest, and any income you make from side hustles or other gigs. To get the most accurate outcome, use last month's numbers.

Use your paycheck stubs, and normalize them to come up with a monthly number.

A. If you get paid weekly, multiply the net number (meaning how much is actually going into your bank account) by 4.B. If you get paid every two weeks, multiply it by 2.Estimate how much in cash tips you typically get paid. If last month seemed about average, you can use that. If you want to be more accurate, add together the last 6 months' worth of tips, and divide by 6 to get an average. Then use this number. Whichever you choose, add it to 1).

If you receive any interest on savings accounts, bank CDs, or other investments, add these to the total. You should be able to locate these payments on statements from your bank or investment firm. Unless you have a lot of money put away and idle, don't expect this to be much.

If you have a side hustle, or make any money outside of your job, estimate how much you're bringing in monthly and add this as well.

If you are a gig worker or self-employed, you won't get a usable net number from your pay stubs. Some of that money won't be yours to spend because federal and state taxes haven't yet been stolen (ah, deducted) from it. You'll either need to estimate your net amount based on what's been taxed in the past, or consult with a tax professional to get a good estimate.

Let's take the make-believe example of Joan...

Joan is a server at a local TGI Friday's. She earns $10 an hour, and over the last six months, has earned about $80 per shift in credit card tips. Cash tips have averaged about $20. She gets paid every two weeks, and her paycheck is about $1,300. Joan also earns about $40 per week on the side, pet sitting.

Using the steps above, Joan's income would be:

($1,300 * 2) + (20 * 20) + (40 * 4) = $3,160 per month

Step 2: Determine Your Monthly Expenses

Fancy finance types like to say that money is fungible. This is one of those terms adored by Wall Street bankers, and often paraded around in an attempt to sound smart (or make you feel dumb and susceptible to sales tactics).

Make no mistake, the concept is important, but all that “fungible” means is that all money, in any form it takes, is the same. Think of it like the opposite of human beings, where everyone is unique. Earning money and spending money are two sides of the same coin, because each and every dollar behaves identically.

Ok, so what? In practice, this means that earning a dollar is the exact same as not spending a dollar you already have.

Now we're getting somewhere.

$100 stuffed in your underwear drawer is the same as $100 in your 0%-interest checking account, which is also the same as 10 hours of work at $10 an hour (before taxes). A penny saved is a penny earned, as you've probably heard. More to the point, it means that if one half of your budget coin is your income, the other half is your spending, while both are part of one big pool. That said, there are a few wrinkles for spending.

Understanding fixed expenses vs. variable expenses

Some expenses are consistent. These “fixed expenses” cost you exactly the same amount of money each time you pay. Usually that means monthly, but it could be on any interval. The licensing and registration fee for your car only happens once a year, for example, but it's fixed. Fixed expenses can change over longer periods, but the important thing is that they're predictable and usually contractual. Your rent won't go up outside of some preset lease terms, and usually not more than once a year. Throughout that term, it's not going to change.

Variable expenses are the opposite. These expenses can vary depending on how much of a product or service you're using, or any number of underlying factors. For example, your utility bill can change based on how much water you're using, the price of natural gas, or whether your city just issued a bond a year ago that now has to be paid. Regardless, you can't count on the number to stay the same over time. It can and will change each time you shop or your bill shows up.

Fixed expenses are generally more difficult for you to change. You can alter your rent by moving, but you're stuck by a lease on when you have that option, and it's going to take time and effort on your part to get it done. Plus, no one likes moving. Variable expenses are usually much easier to cut back if it comes to that.

The drawback is that cutting back on variable expenses often hits your psyche harder, and it requires you to be vigilant. If you find cheaper insurance, it's a big win for you mentally because you won't even notice the difference in what you're getting. Cutting back on that Starbucks trip from daily to weekly is something that you're going to notice, and notice each time it happens (or doesn't happen).

For this reason, fixed expenses are typically budgeted first. Then variable expenses can be plugged in to fit in with the remaining money.

Pro-Tip

ALWAYS PAY YOURSELF FIRST.

Where does saving fall into the fixed vs. variable picture? At first, you might think it's variable because whatever is left over at the end of the month gets saved. But it actually depends on your budget style. Some budgets explicitly assign saving to a category, so money ALWAYS gets saved, just like your utility bill getting paid. Then whatever is left over is spent. This is a critical difference and can be a big boost to your savings efforts.

Fixed expense examples:

Rent

Mortgage

Car Payment

Car Insurance

Saving

Variable expense examples:

Utilities (sometimes

Groceries

Entertainment (movies, dining out)

Clothing and shoes

Understanding required spending vs. voluntary spending

The other way to understand and categorize expenses relates to need. For certain budgeting strategies, this is important. You may hear this called necessities vs. discretionary spending, or (confusingly) fixed vs. discretionary. It just means that some spending has to be done, while some spending is optional.

There's a level of grayness here that you'll have to power through. For example, you have to eat — that's required. But the costs can vary wildly. A night out dining on Beluga caviar or French Ortolan (it's horrific - look it up) isn't the same thing as grabbing Wendy's or a pack of Ramen noodles from 7-Eleven on the way home from your shift.

By and large though, it's relatively simple to separate what you truly need and what you don't. Your car payment is a required expense. So is your car insurance payment. The three 15-inch sub woofers stuffed in the trunk and the pink Justin Bieber license plate frame are voluntary.

If you have any doubts, there are a couple simple ways to quickly decode whether something is truly required.

Is there a lower-cost alternative that isn't going to affect your lifestyle? McDonald's is a lower-cost alternative to TGI Fridays. Dumpster diving for scraps isn't. A purse from Target (or the one on your shoulder now) is an alternative to that $300 Coach Small Town Bucket. Hauling around your stuff in a Walmart grocery bag might not be. Just be reasonable and this is pretty easy.

How do you feel when you buy it? If you're honest with yourself, buying necessities is pretty ho-hum, while getting something cool (read: voluntary) gets you amped up and waiting anxiously for the UPS truck. If you find yourself fantasizing about something, you can be pretty sure it isn't a required expense. Nobody spends 30 days waiting impatiently for their next rent payment to arrive.

Understanding expense types - examples

Voluntary | Required | |

|---|---|---|

Variable | Entertainment, dining out, shopping | Gas, groceries, utilities (some) |

Fixed | Subscriptions, cable, data plans | Rent, car payment, insurance |

How do I figure out my expenses?

So how do you figure out your spending? This step can take some time, so it's important to commit ahead of time and see it through. There are a number of different ways to tackle it, but the most accurate way is to gather your bank account and credit card statements over the last three months, and get to work. Your goal here is to convert the huge list of your spending items on those statements into a list of categories and spending types, which you can then plug into the budget type of your choice.

Here's how to do it.

Open a new MS Excel or Google Sheets document (or use this Cashbasic template)

Template: This version is locked for editing, but you can make a copy for your use by going to File - Make a copy inside of the Google sheet ( note: you'll need to be logged into Google for this to work ). If you prefer, you can create a new Google sheet or MS Excel document and just copy the column headers from the template.

Template: This version is locked for editing, but you can make a copy for your use by going to File - Make a copy inside of the Google sheet ( note: you'll need to be logged into Google for this to work ). If you prefer, you can create a new Google sheet or MS Excel document and just copy the column headers from the template.Type in each of your expenses, document the date and amount, and assign a category

Template: Use the Expenses tab for this

Template: Use the Expenses tab for thisCreate a total for each expense category

Divide that amount by 3 to get a monthly average

Type in each category and monthly average, and figure out if each category is fixed or variable, and required or voluntary

Template: Use the Categorization tab for this

Template: Use the Categorization tab for this

Categorizing your expenses, visualized

IMPORTANT NOTE

This exercise gives you both the categories and the total spending in each. But the categories are the most important. The totals tell you what you've spent in the past, but this may or may not be what you WANT TO SPEND going forward. It'll give you a ballpark about what to expect, but your budget strategy should set your spending amounts, not your past spending .

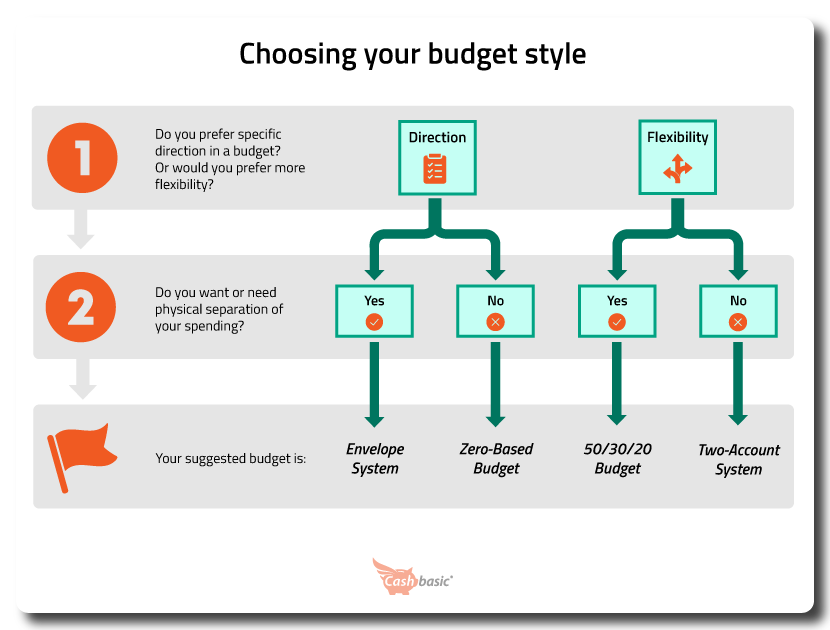

Step 3: Choose a budgeting method

Here is where your earnings and spending come together and create something meaningful. There are dozens of different ways to budget your money, but most of them are minor variations on the same theme, and a lot of them are unrealistic (or just terrible). There are a few tried-and-true strategies.

The key is to pick the budgeting method that fits your lifestyle, financial goals, and personality. So explore them and see what works best for you — each has its own drawbacks and plusses.

Budgeting Strategies

The 50/30/20 Budget

The 50/30/20 budget was popularized by Elizabeth Warren (pre-Senate, by the way) in her 2005 book All Your Worth, and has gathered a devoted following. You'll also hear it called the “three-column budget”, so just know that it's the exact same concept. Warren's research showed that complicated budgets aren't needed or even effective, so the idea behind 50/30/20 is practicality and simplicity- keeping you inside some rough guardrails without being overly prescriptive or rigid. If you're looking for something that tells you exactly how much to spend each month on each category, this isn't going to be the one for you.

Put simply, 50/30/20 requires that you take all of your income, and divide it up, with:

50% going to your required spending (Warren called these “must-haves”). This is what you'd expect: your rent, car payment, insurance, etc.

30% going to your voluntary spending (things that you want, but don't need). This is obvious too: new clothes, shoes, and almost anything that you're buying on Amazon

20% going to payments on money that you owe, if you're currently in debt. Think: credit cards, student loans, etc. And if you're debt-free, it goes to saving

You've probably noticed a common theme with financial and budget advice: if you're overspending, cut back on your wants. Go generic, watch out for spending too much on lattes at Starbucks, and pack your own lunch. One of the unique (and positive) things about the 50/30/20 strategy is that it encourages—actually requires—a relatively large amount of spending on things that you want. Sound fake? It's not, because the 50% assigned for boring essentials isn't a minimum, it's also a maximum ... a set number.

What's that mean? Well, if you're spending more than 50% of your income on your required expenses, you have to figure out a way to cut back on the necessities. That's not how most budgets work, but it carries a significant number of benefits to you.

HOW TO SET UP THE 50/30/20 BUDGET

To implement 50/30/20, start by taking your income and divvying it up based on the 50/30/20 percentages. Then compare the spending you calculated in Step 2 to what 50/30/20 states it should be based on the division above. For example, if you're earning $3,160 per month, your budget will be:

$3,160 * 0.50 = $1,580 on required expenses

$3,160 * 0.30 = $948 on voluntary expenses

$3,160 * 0.20 = $632 on debt service or saving

If your required spending clocked in at $1,700, you'd need to cut back $120 per month from it. That could mean shifting to a lower-cost cell phone plan, dropping expensive insurance in favor of a high-deductible policy, or getting a cheaper car and lowering your payment.

Get your simple 50/30/20 budget in less than a minute, using Cashbasic's free calculator.

PROS AND CONS OF THE 50/30/20 BUDGET

Pros

50/30/20 Budget

Automatically set up to pay yourself first

Simple, easy to stick to

Assigning large amounts to wants reduces need for credit card debt to support your lifestyle and sanity

Cutting back required expenses can often save you a lot more money than voluntary expenses

If anything unforeseen happens, gives more flexibility (since you can cut back on the 30% in emergency)

Requires fun spending, but also limits it thoughtfully

Cons

50/30/20 Budget

Not specific enough for everyone

Minimal detail to help you track which interests you're spending on

If 20% isn't enough to make major strides in debt repayment, can stall your efforts to get out of debt

Fixed percentages may not adapt with your life as you grow

The Envelope System

Cash is dead. Cash is a relic. Cash isn't necessary. You've heard it before, on the news, on social media, and from self-styled experts. But no matter how many times it gets repeated, it's flat wrong. People still use cash widely, and it accounts for 26% of all payments, and almost 50% of payments under $10.

The Envelope System embraces cash. In fact, it's one of the only widely-used budgeting strategies that is actually physical, and it requires that you use a specific payment method. If you're just starting to focus on your finances, you're the type that needs a little more specificity and direction, and you're willing to use cash when possible, the Envelope System can be a great option.

So how does it work?

The setup requires some thought and organization, but the process itself is relatively simple. You assign each spending category its own envelope, add the appropriate amount of cash for the month, and then each time you have an expense in that category, take from that envelope to pay for it. And that's all you can spend for that category — once the envelope is empty, that's it for the rest of the month. No stealing from other envelopes or you'll royally screw up the process.

If you have anything left over at the end of the month, you can either leave it for the following month, or better, shift it to another envelope for savings. Since you aren't spending it, that cash should eventually make its way to your bank, by the way.

The huge benefit here is that the Envelope System forces you to account for how much you have before spending, and that's much easier and intuitive with physical cash than it is with a bunch of numbers on your bank's website or app, or worse, with a credit card statement after the money's been spent.

The Envelope System is extra useful if you're prone to overspending on certain things (looking at you, Starbucks). That's because A) research shows it's more psychologically painful to spend cash than use credit, and B) once your allocated money for a category is gone, it's gone. That's it.

HOW TO SET UP THE ENVELOPE SYSTEM

To start, you'll need to be at least a month ahead of your bills and spending to “prime” the system. You'll want an entire month's worth of spending, in cash, right there on your kitchen table (just keep it away from your food).

Take each of the spending categories you created earlier, and give it its own envelope.

There's some flexibility in how many you use, but you want enough to make it meaningful, but not specific enough to make your system unmanageable.

A. Start with the categories that you created earlier.

B. If you have a specific habit or something you spend on that you want to track, go ahead and give it its own envelope. That could be something like “Starbucks” or “beer”, or whatever you'd like. But don't do this with everything or you'll lose your mind trying to stay organized.

Write the name of the spending category on the front. Then write the month/year and the amount of cash you'll include for that month. This will help you keep better records and remind you how much to add next month when you refill it.

Add the cash to each envelope.

When you spend in each category, spend only cash from that category's envelope. When that cash is gone, it's gone.

At the beginning of the next month, refill each envelope.

Store these somewhere private, especially if you have serially poor (or potentially desperate) roommates. It's quite the story, but I once had a roommate who stole another's checks and forged his name on them for cash. Who does that? Don't chance it.

Even if you have some bills that can't be paid in cash, it doesn't totally disqualify the Envelope System for you. As an alternative, you can pay for those non-cash expenses however you need to (card, bank account draw, etc.) and assign cash envelopes for the rest of your categories.

PROS AND CONS OF THE ENVELOPE SYSTEM

Pros

The Envelope System

Easy to tell at a glance how much you can spend at any time

No need to keep complex records

No surprises

No risk of going into debt to support spending

Works well for those who deal with a lot of cash, like jobs with tips (or other careers that aren't a topic for polite conversation)

Cons

The Envelope System

Cash can be lost

You can't buy online, and often can't pay fixed expenses in cash

Need to be a month ahead to prime the system

The Zero-Based Budget

The Zero-Based Budget was invented by accountant Peter Pyhrr back in the 1970s when he was working for Texas Instruments, and really hit it big when Pyhrr was asked to make it work for the state of Georgia's budget by then-governor Jimmy Carter. Carter later put it to use in the US federal government in the late 70s, launching its reputation into the stratosphere.

Clearly there's big potential built into it, but the Zero-Based Budget works just as well in personal finance as it does in the government and corporate world. Because the principles apply any time that there's money coming in and money going out. The main idea is that, at the end of the month, your earnings minus your expenses always equal zero. If you earn $3,160 for the month, everything that you spend, save, donate, lose in the couch cushions, or whatever, needs to add up to $3,160. To make that work, every dollar that you earn is given a job.

Those jobs are assigned at the beginning of the month. You stick with that preset formula for the entire month, and at the end of the month, scrap it (that's right). Then you evaluate what worked, what's staying the same, what's changing, what's needed for the upcoming month, and then create a new budget to cover it.

The key principle here is that everything is done ahead of time, at the beginning of the month, and then religiously followed. No exceptions. And at the end of the month, you shouldn't have anything left. Here's a basic example to illustrate:

| Starting monthly income | $5,000 |

|---|---|

| Living expenses | $2,000 |

| Debt payments | $1,000 |

| Savings | $1,500 |

| Voluntary spending | $500 |

| Ending monthly balance | $0 |

HOW TO SET UP THE ZERO-BASED BUDGET

Prior to the beginning of the month, take each of your expense categories, and list them out.

Use your previous spending as an estimate, and assign each category a dollar amount.

Total these, then subtract them from your monthly earnings. Does the total equal $0?

If not, adjust the numbers to bring the total to $0. If you end up with a negative number, that means you've been overspending relative to your earnings, and you need to be thoughtful about bringing the total spending down. Skip to the tips below if youre struggling with this.

Review your numbers. Do you feel that you're spending too much or too little on a category? Now is the time to make that adjustment. Just be sure that if you increase or decrease a category, you also increase or decrease another to bring the total back to $0.

At the beginning of the month, start tracking your spending. Each time you spend on a category, document it. You can use paper, an MS Excel spreadsheet or Google doc, or an app. Do this consistently throughout the month.

At the end of the month, review your budget, consider any expenses that you might encounter that didn't happen last month, and then start the process again.

PROS AND CONS OF THE ZERO-BASED BUDGET

Pros

The Zero-Based Budget

Accounts for less frequent spending, like holidays and annual charges

Offers good visibility into spending

If done right, prevents overspending 100% of the time

Cons

The Zero-Based Budget

Can be a lot of work to create and maintain

Can be even more challenging when you have unpredictable income

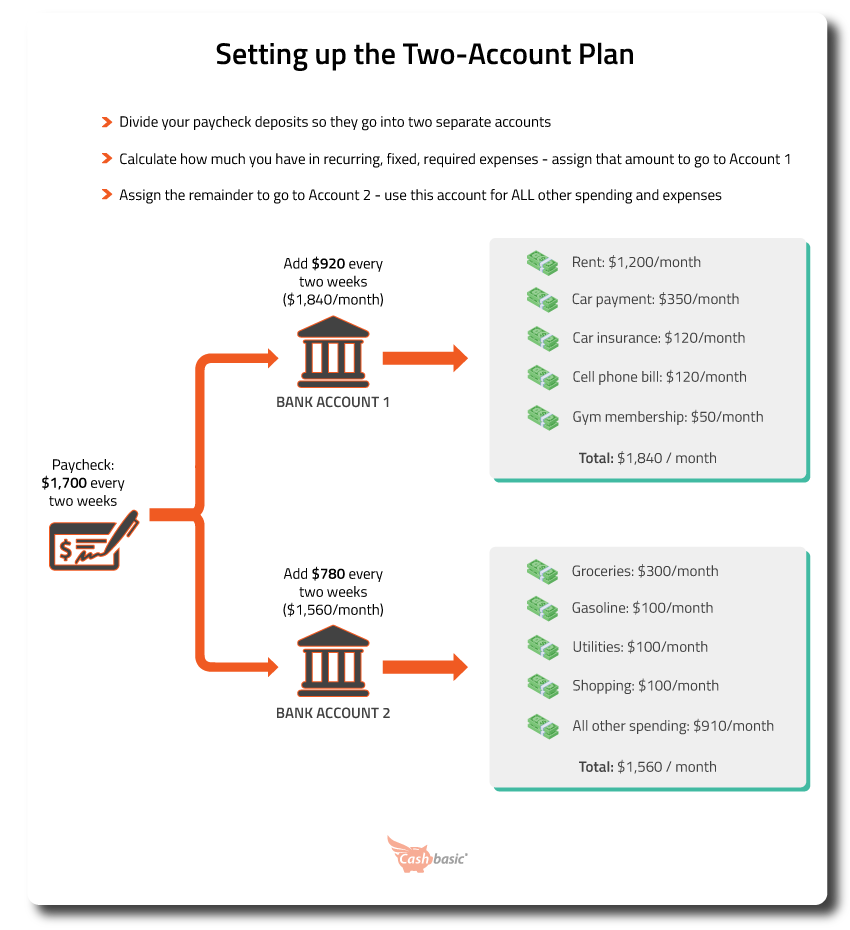

The Two-Account Plan

Have you ever had to deal with two people who just couldn't seem to get along? Whether it's bickering toddlers, or grown adults who act like toddlers, sometimes the best plan is to just physically separate them. If you think about your spending obligations as competing, bickering interests, it may be time to just separate them. That's the idea behind the Two-Account Plan.

You might have guessed that the Two-Account Plan uses...two accounts. Each has it's own purpose.

Account 1 is used exclusively to pay for your fixed, required expenses, like your rent, car payment, insurance, and other recurring must-haves.g else.

Account 2 is the fun one: used for variable required expenses, voluntary spending, and anything else. This could be gas, groceries, fast food, shopping, getting blasted, or anything else.

Given that fixed required expenses make up a large portion of most peoples' budgets, expect Account 1 to absorb at least half of your money.

HOW TO SET UP THE TWO-ACCOUNT PLAN

Open up a second checking account.

Note: If your bank is going to charge you for the account (watch out for minimum requirements), close your existing account, go to a different bank and open two accounts there. Since you're going to be making changes to your deposits and payment links, now is the time. Don't pay $10-20 or more each month to give the bank your money.

List each of your fixed, required expenses, and set each of them up to be deducted from Account 1. If you need checkwriting to accommodate certain bills, then be sure to get it set up on the account.

Take note of the total amount needed to cover these expenses. Divide this by the number of times you get paid each month. This will give you the amount that should go into Account 1 from each paycheck. Add no more than this.

Update your direct-deposit from your employer (or manually set this up if you get a check) to be split. Assign the amount from 3) to go to Account 1, and the remainder to go to Account 2.

Any time you need to spend money, it should come from Account 2. In fact, you probably shouldn't even have a debit card on Account 1, since there should be no optional spending from the account. At minimum, don't carry a card with you.

PROS AND CONS OF THE TWO-ACCOUNT PLAN

Pros

The Two-Account Plan

Built-in budgeting with minimal effort after the initial set up

Very little maintenance

Makes sure that your fixed expenses are always covered first

Cons

The Two-Account Plan

Have to manage more than one account

May carry fees that are harder to waive since one of your accounts is always being drained and generally carries a low balance

May not work as well when you have a lot of variable required expenses

Pro-Tip

CONSIDER UPGRADING YOUR TWO-ACCOUNT PLAN TO A THREE-ACCOUNT PLAN.

With the Two-Account Plan, consider opening a savings account as well. When you have extra money left in Account 2 at the end of the month, transfer that money into your savings account. You won't see it any more, and eventually you'll forget all about it. In the meantime, it grows for you, instead of being spent just because it's there. To really make this work, use a savings account at a bank that's different than the one where you keep your two checking accounts.

The Strangler

Haven't heard of this one before? Hmm that's odd.

With this budget, you don't spend your money.

On anything. Ever.

Want that new iPhone? 50/30/20 says put it in the 30% column. The Strangler says forget about it. Got your eye on a new laptop? Look somewhere else, like the library. Just saw a designer pair of shoes on Instagram, and they're even offering a coupon code? Double no. Go to Walmart, or better yet, bum a ride to Goodwill.

If it won't result in you becoming homeless, emaciated, sick, disabled, or unable to work, you don't spend on it. Money stays put. Optionally, put the money under a mattress or bury it in your back yard to really streamline the process of not spending it.

Is never leaving your house starting to cause issues unrelated to money? That's not the Strangler's problem. Don't make it the Strangler's problem by going out and spending money.

HOW TO SET UP THE STRANGLER

Set up for The Strangler is minimal and requires little experience or fancy implementation. You actually can do less than you normally do.

Don't spend any money.

Don't spend any money.

Don't spend any money.

(Optional) Watch your bank account grow. You won't have much else to do.

PROS AND CONS OF THE STRANGLER

Pros

The Strangler

Extremely simple to set up

Zero math required

Highly effective at saving money quickly

Works well for minimalists and people with no friends or social life

Cons

The Strangler

Challenging to get started

Challenging to sustain over the long term

Requires significant expenditure of willpower

Known to lead to non-budget related problems

Given the main idea of the budget, hard to see what you'll ever do with the money you save

Step 4: Set yourself up for success

Did you know that newborn babies are given a hearing test before they're allowed to leave the maternity ward? Of all things to be concerned about, does that seem strange? Here's why it matters: it turns out that even though they can't respond or understand language, the first few months of life are imperative for the development of language and communication. A couple weeks of intervention early in life could be worth years of therapy and trouble down the road.

With budgeting, a few tweaks and thoughtful decisions at the starting line can be much more impactful than anything else you do later on. Here are some important questions to ask yourself to make sure you've covered your bases. Start off on the right foot and reap the rewards for years.

Have I tried to budget in the past? What worked and what didn't? Research shows that the best predictor of your future behavior is often your past behavior. This isn't to say that you don't change and learn, but if you know how you've dealt with things in the past, you can make an educated guess on how you'll handle similar situations and obstacles in the future. Use that experience to your advantage when deciding which budget to use and how to set it up. Did you struggle to stay on track and give up when you tried to track every expense? It's probably time to try a simpler option.

Which budgeting strategy best fits my personality? Are you an organized person by nature? Or more of an intuitive, seat-of-the pants type? It makes a difference in which budget you choose. An artistic person might consider a regimented office job like living in a straitjacket. Where an analytical mathematician would likely go crazy in a high-touch sales job or in politics, where success isn't going to be determined by intellectual horsepower. These just aren't good fits. It's the same with budgets (along with about anything else). If you pick something that fits neatly inside your personality, it'll be much easier to find success. If you aren't that organized and aren't interested in learning, something like the Zero-Based Budget is going to be too much of the wrong thing. You'll be better off using 50/30/20 or the Two-Account Plan.

How do I need to build my budget to help maintain my sanity? All work and no play makes Jack a dull boy. And also makes him much less likely to keep his head in the game and stay focused. If you build your budget to be 50% fixed essentials, 30% variable essentials, and 20% savings, is that realistic? Are you really going to spend $0 over the month on things that you want to? Or are you just going to bust the budget mid-month and toss in the towel? Give yourself the flexibility to be human. Build your personal requirements INTO the budget so it can flex with you, instead of breaking when you're just being you. This helps you stick with the plan but still gives you what you need to succeed.

Step 5: Get mentally prepared

Baseball pitcher Turk Wendell used to brush his teeth between every inning and would hop over the foul line each time he made his way to the pitcher's mound. He also made sure that he stood up whenever his catcher crouched, and crouched when he stood. Turk didn't do this to prevent cavities or to keep the line chalk off his cleats. He did it because he thought it would help him perform. Whether there was any truth to these superstitions or not ( not ), there's no denying it got him mentally ready to go do his job.

You may not want to hear this, but the truth is that setting up your budget is the easy part. And if you've never worked from a budget before, you need to understand that it's going to be a change and a challenge. Embrace that, know it going in, and prepare yourself mentally to do the work. You'll need grit to plow through the inevitable bumps. Here are a couple ways to get ready and persevere.

Take control and don't give it up. Know that things don't just happen to you, and that you do have control and influence over your life. Write this on your bathroom mirror or the inside of your front door if you need to, but always keep it top of mind.

Have confidence in yourself and your ability to do difficult things. There's a famous quote from automaker Henry Ford that neatly sums up the importance of confidence: Whether you think you can, or you think you can't, you're right. If you're in a rut, think of all of the times that you've encountered challenges in the past and have come out better for it. You're still here, right? Self-confidence is not self-esteem. Esteem is about what you think you deserve. Confidence is what your experiences prove you can do. If you're having challenges, take a critical look at the people you hang out with, the words that you use, and even the music that you listen to. Do these things lead to optimism? If they make you feel self-pity, they may be holding by back psychologically.

Whether you think you can, or you think you can't, you're right.

- Henry Ford

Once you've started, and you've racked up a few small wins, celebrate them, and find a way to reward yourself. This gives you a subconscious mental connection between what you did and a pleasant outcome. Positive reinforcement is one of the best ways to encourage good behavior (even your own).

Forget about motivation. It might be able to get you off the couch and get started, but it's an unreliable partner. If you went on a road trip with motivation, he'd drive about 120mph nonstop for the first few hours. You'd think, “wow, this guy is a little nuts, but we're making great time”. Then about halfway to your destination — probably in the middle of the night — he'd pull into a rest stop, kick you out of the car, and turn around and drive home. If motivation doesn't work, then what will? Good habits and discipline. So if you aren't motivated, don't worry about it. But do what you need to do anyway.

Tips to bring your budget under control

Starting on a budget is a challenge. You'll encounter issues and hit road blocks. Count on it. So you need to be sure you're starting out with your best foot forward. If you're having troubles getting your budget to add up and work, the time to work that out is now. There are some tried and true ways to coax and cajole your budget into line. Each of them has one thing in common — cutting spending. Here goes.

Easiest

Lower your insurance premiums with higher deductible policies

Shift all insurance to one company to qualify for discounts

Get quotes from competitors and ask your insurance carrier to beat it

Get rid of insurance you don't need

Ask your student loan servicer if you're eligible for discounts or grants

Harder

Drop your unlimited data phone plan and shift to something cheaper

Cancel or downgrade your cable

Go through all of your subscriptions and cancel any that you don't use anymore

Hardest

Try to cancel non-essential longer-term contracts that are tying up your spending

Get a roommate to cut back on rent expense

If you are renting ANYTHING besides the roof over your head, give it back

Sell your car and buy something that carries a lower payment

Move somewhere cheaper

Budgeting tools

Out of all the aspects of budgeting, the tool or tools that you decide to use are the least important. That's because the only real purpose of your budgeting tool is to help you stay organized and keep good, reliable records. However, unless you've got an eidetic memory, you'll need something to assist in your budgeting process.

There are too many options to list them all, but here's a small sample of ideas:

Online software and websites

Budgeting software you can install on your computer

Smartphone apps

Templates for MS Excel and Google Sheets

A spreadsheet (Google Sheets or MS Excel work well)

A specialized paper planner

Plain pen and paper

Don't wait, start now

You now know everything you need to know to get started on your own budget. You have a few different budgeting strategies to choose from, each with its own style, drawbacks, and advantages. You've got some tips to stay on track. And you even have a few ideas on how to get everything going on paper (or in an app).

Now, the next step is TO START. Don't search for more information. Don't wait for some sign, or for the stars to align and give you the go ahead to move. Just start. Once you have the information you need, any further examination or research or searching is just procrastination in disguise. The sooner you start, the sooner you can start making mistakes, learning, adapting and changing. Once you're moving, you can easily make adjustments on the fly.

Remember that what you are today is a result of your decisions yesterday. Who you'll be tomorrow, next week, and next year will depend on your decisions TODAY. Author John Maxwell put it best in his (excellent) book Today Matters. He says Who we are today is the result of choices we made yesterday. Tomorrow, we will become what we choose today. To change means to choose change.

Video coming soon...

Share this post

There are no comments yet.

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.