Budget questions: Top budgeting questions to ask yourself

Pete Zimmerman | 1/31/23

This post at a glance

( TL ; DR )

If you're in a hurry, you can also hit GO TO VIDEO below

Read time: 12 minutes

Summary: The world is drowning in information and answers. The trick is to ask the right questions. This goes for financial topics especially, which seem complex but can be dramatically simplified by digging in and getting very specific. There are hundreds of budget questions you could ask yourself, but only a few of them are truly important. Here are the top questions and their answers.

Budgeting can be confusing, but asking the right questions can put you ten steps ahead

Would you say that staying ahead and informed financially is easier today than it used to be? Is it simple and easy?

If your answer was "yes", feel free to hit eject. Reading further is probably a waste of your time.

But if you think that things are getting more complex, and your finances feel like a lonely dollar bill being thrown around in a swirling, raging storm of financial danger, then trust your gut. You may be on to something.

In the face of all of this uncertainty, budget questions and financial questions go unanswered ... swept under the rug by working-class people who don't have the time or knowledge to tackle them. Many people struggle to understand critical financial concepts like inflation, interest, and bankruptcy. And over half of people in a GuideVine poll felt lost when it comes to a long-term, stable plan for their finances.

It's a problem and it's growing constantly, like an ominous storm gathering on the horizon. And you're on your own. No one is going to come save you ( research shows most people can't even save themselves ).

So... what do you do?

How do you even start in the face of such madness? The answer is that you focus on the things you can control. One of those things—and arguably the most important—is your personal budget. Budgeting can be a pretty involved topic. It tends to create a lot of questions. Some of those questions can be safely ignored. But others are CRITICAL. We're going to cover the TOP budget questions to ask yourself.

But first...

Answer your budget questions truthfully

A recent study showed that 78% of people are concerned with the state of their finances. Clearly, feeling pressure and anxiety regarding your money isn't uncommon. But everyone's situation is unique, and most advice that you've heard in the past probably wasn't tailored to you or your life.

So when you answer these budget questions, don't fall back to some cliche or something you've heard in the past, since it may not have really applied to you in the first place. Deciding to start a budget is a big step and requires full transparency, even with yourself. You'll get the most out of this if you answer honestly and thoughtfully. There won't be a test at the end.

If you like punishment and want to make an intimate and complex topic even more difficult, just add in another person (your significant other). It can be a challenge to be honest even with yourself, so money and budget questions can leave you feeling vulnerable when you're revealing the answers to someone else. Maybe they aren't aware of your financial past, or you've committed financial infidelity (what a term...). Or maybe it's a topic you've purposely avoided.

If you're feeling reluctant or nervous about this, consider answering the budget questions separately. Once you're done, have an open and honest conversation about your finances and mutual goals for your money.

Ok, here we go.

Question 1: What is my true monthly income?

A clear understanding of your monthly income is crucial to managing your money. Without it, you're groping around blindly. Too often, people calculate their income based on their gross income instead of net income (meaning, after taxes and other deductions).

If you make $40,000 a year, and get paid every other week, you (unfortunately) aren't bringing home $1,550 a paycheck. It's closer to $1,300 after taxes and other expenses. That's a big difference. If you make tips, you should include those with your incom. Again, just the takehome portion. Tips are taxed also.

Budgets get created in advance, so you only want to base your calculations on your base take-home pay. Any overtime or bonuses are a plus, but aren't reliable enough to be included in your budget. You'll determine what to do with excess pay later. When you build a budget, the more accurate you are about your monthly inflows of money, the better success you'll have staying inside your spending guardrails.

Question 2: Do my goals align with my reality?

Important budgeting tips include having realistic goals. Can you afford a Maserati on a waiter's salary?

Probably not.

And that's ok. Not being able to afford your dream car doesn't mean you can't plan and budget for a new car (or at least new to you). Maybe something more reliable or not as embarassing.

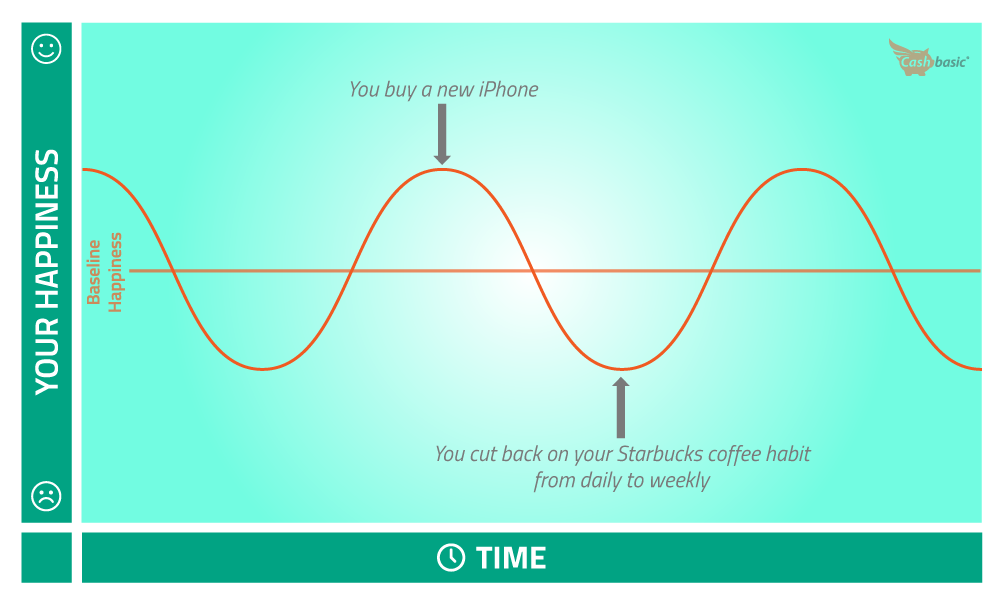

And as it turns out, thanks to a crazy (but relatable) phenomenon called the "hedonic treadmill" your long term happiness will probably be about the same with that $10,000 Toyota Corolla as it would be with that $82,000 Maserati, anyway. Your happiness generally hovers around a given level. And it drops (or rebounds) back to that level pretty quickly, regardless of what happens to you.

Don't believe it?

Ask yourself how many things that you've bought over the last year still bring you the joy that they did at the beginning? If you're being honest, the answer is probably "not many". Maybe "none".

This isn't limited to spending, either. It's part of being human.

Just for fun , listen to this...

In a 1970s study by researchers at Northwestern University and the University of Massachusetts, lottery winners were asked to rate their happiness on a scale of 1-5. What was the average?

About 3.5.

Hmm, not as high as you might have expected, right? But here's the striking part. The researchers also asked the same question to people who had lost use of their legs (or their arms and legs) in an accident. Their answer?

About 3.5. Nearly identical.

Again, our happiness trends toward a specific, personal level, regardless of what happens to us. And regardless of what we buy.

So understand and own your financial reality. Because when your goals don't align with your reality, it gets much easier to slide into a rut and lose focus, or just give up on your budget altogether. Here are two budgeting questions to ask yourself when your budget is centered around specific goals.

What are my short-term goals?

Short-term goals are the things you want to get done within a year. With these, you don't have a lot of time to save and prepare, so they need to be bite-sized if you want to have any shot at getting them done. The upside is that there is also less time for things to go wrong or for your priorities to change.

Here are a few examples of short-term goals:

Get a basic emergency fund in place ($500-$1,500)

Financially prepare to find a new job

Buy a new car

What do you need to do to prepare for these goals? What changes will they require in your life and your spending habits? Answering these budget questions gives you an idea of what it will take to be successful, like getting that new car within the next 12 months. A larger downpayment will dramatically decrease your monthly car payment. But that downpayment doesn't grow on trees and has to be saved beforehand.

The takeaway?

You'll need to save more now, but your expenses will be lower in the future. This has to be built into your budget.

When budgeting for short-term goals, remember to include all additional expenses that you may be hit with (with the car example, that would be thing like insurance, gas, and maintenance). Remember, you generally won't have the time to adapt, so it's best to be thorough.

And most importantly, be realistic about how long your goal will take, and make sure that it shouldn't actually be a long-term goal.

What are my long-term goals?

Long-term goals are typically more than a year away, usually 2-5 years. They're also often larger financial commitments. You have much more time to plan and save for long-term goals, and more time to adapt. The downside here is that it can be hard to stay on track over longer time periods. A long-term goal could be to buy a house in five years. Or paying off your credit card debt or student loans.

To best budget for long-term goals, consider opening an inconvenient account where you can deposit savings. Five years is a long ways away, and this money is going to need to accumulate for awhile, so you will want to protect it (even from yourself). If it's just sitting in your checking account, you're much more likely to raid it for impulse purchases. Think of it like a plate of cookies sitting on your table versus sitting in the pantry. Out of sight and out of mind applies here.

Here are some examples of long-term goals:

Buy a house

Save and prepare for trade school or college

Pay for a wedding

Question 3: How do I change my spending habits?

The entire idea behind a budget is to control your spending and to divvy up your limited money in ways that best suit you. Once you have that plan, the two most important tactics to start and keep your budget on track are 1) accountability to yourself, and 2) development of good habits. You probably won't give up your daily Starbucks coffee overnight. But you can decide how important it is relative to the rest of your priorities.

And here' the honest truth:

The only person who can decide your priorities is you. It's your life to live how you choose. So, what's important to you? Try ranking your interests, or ordering them by importance. What can't you live without and what can you give up to keep those priorities where they are?

Unfortunately cutting back spending in some areas is almost always going to be necessary to make room for your higher priorities. If you treasure your morning Starbucks coffee, you may need to cut back on weekends out. There's only so much money to go around, right?

When you know what to cut, start slowly. Give yourself time and grace to adapt and change. If you prefer to party with friends on the weekends and that means that the $5/day coffee has to go for you to stay within budget, let yourself keep the Starbucks on Fridays only. Then scale it back later.

Racking up little wins, one at a time, helps you build good habits gradually. If you're interested in some great advice on how to build positive habits, check out Atomic Habits, by author James Clear. It'll change your life.

Question 4: Where does saving fit into my budget?

Budgeting shouldn't just cover what you spend — it should also include what you save. Your saving should be deliberate and built right into the budget, so you can be sure it doesn't get lost or put on the back burner. Pay yourself first. Or at least, make sure it's in the plan and not an afterthought.

Let's be real here: saving isn't fun.

But there are some solid ways to bring it to life and visualize what your efforts will do for you. Almost everyone can benefit from an emergency fund and the peace of mind you get from it, and long-term goals like buying a house or paying for a wedding require long saving runways but also have a fullfilling payoff (hopefully...). Think of what you'll get with that money in the future, not the money itself.

To really ramp up your savings efforts, bump it higher every time you receive raises or pay off a recurring monthly bill. If you get overtime pay, consider diverting it to a savings account. You can also find small, creative ways to save , and send that money to your savings account also. If your budget is so tight that you can't bear to divert money, start small by saving just $10 each time you get paid. It adds up.

Question 5: How do I recover from emergency expenses?

Unless you live in bubble, there's nothing you can do to prevent emergencies. Or the expenses that ride along with them like an annoying little brother, poking you in the arm and screaming "pay me! pay me!" while you try to pry the door open to escape.

A slipping transmission in your Honda may mean using a credit card or raiding the savings you'd set aside for a new phone. This sucks, but all you can do is expect (and plan for) the unexpected. To keep these unexpected expenses from shattering your budget, consider building an emergency fund to absorb them. Check out this do it all guide if you're interested in learning exactly how to do it.

How much should be in your emergency fund? Use this simple calculator to find out in less than a minute.

If you don't have an emergency fund and have to use a credit card, be sure to set a timeframe for paying off the debt. Paying off a $500 expense for a car repair over 12 months comes out to $50 a month. You'll pay around $51 in interest. Cutting your payment to $25 will more than double the interest you pay. You probably don't want to compound an emergency expense with extra interest on top of it.

Question 6: Am I making unnecessary purchases? Or spending in ways that don't even make me happy?

Unnecessary purchases are things you buy on impulse. If you're trying to budget in earnest, you'll need to plan to avoid buying things you don't need. Instead of spending time browsing Amazon, find free activities, apps, or games to fill the time (just watch out for those hidden game fees). If you're having trouble with shopping and impulse buys, delete apps for your favorite online stores. Make it harder to spend.

Also, think through the things you do that might lead to impulse spending, directly or indirectly. Any ideas?

Some of them aren't that difficult to uncover. Spending time browsing in store that you like is going to lead to more spending. The same applies to online shopping, adding things to "favorites" or wishlists, or letting Amazon make recommendations based on what you've bought in the past.

But other ways are more subtle. And one of the biggest villains when it comes to driving unnecessary spending wears a clever disguise. It looks like your friends and family. Or hobbies. Or causes that you care about. But in reality, it's an algorithm designed to make you spend.

See where this is going?

Social media.

A Credit Karma/Qualtrics study of over 1,000 US consumers shows almost 50% of millennials have spent money they didn't have and gone into debt to keep up with their friends. Over 70% of those piling on FOMO debt have added more than $100, with 32% racking up more than $500. That's some serious unnecessary spending. Check out this post if you're still skeptical about what motivates that spending.

To really understand if you're prone to impluse spending, take a quick inventory of your purchases over the past six months. Create two columns, one for things you needed and planned to buy and the other for things you bought on a whim. If you're spending even close to the same amounts on planned versus unplanned expenses, then it may be time to honestly (painfully...) ask yourself if you're making too many unnecessary purchases.

Question 7: How do I keep track of my budget throughout the month?

To be successful with your budget, you'll need a way to keep track of your spending and your progress throughout each month. Luckily there are a lot of options out there for this. In reality, the tool (or tools) you use for this aren't the #1 factor in budgeting, but they're still important. There's really no other way to know what, when, and where you're spending in real-time.

Real-time access to your budget allows you to check your progress before making an unbudgeted purchase. Plus, you can create scenarios to see the impact on your existing budget and estimate if your resources are going to cut it.

Again, there are MANY resources out there for this. Don't spend a lot of time worrying about it, and just take your pick. Your budget type, your plans, and your mental toughness are much more important than the tools you use.

Question 8: Could I live on an allowance?

When you were a kid, were you given an allowance by your parents? Like $20 a week to spend on what you wanted, as long as you did your chores? It's a solid way to get kids exposure to money, and teach about responsibility, prioritization, and the effects of their financial decisions (mostly, running out of money).

But it's also a good way to control your spending. Living with an allowance as an adult is tricky...you'll need discipline and honesty, because it's completely self-imposed. To stay on track, you can set up alerts with your bank to monitor withdrawals and balance thresholds, which will give you reminders when you're straying outside of your allowance and goals.

There are even some budgeting strategies that fit really well with the "allowance" theme. The best is the Envelope System, which uses actual cash divided among your different spending categories, using—you guessed it—envelopes. Money is added at the beginning of the month, and once it's gone for the month, that's it until next month. If the idea of living on an allowance seems like a good fit for you, try out this budget. Learn more here.

Question 9: Should I consider new ways to bring in money?

Most of the focus on budgeting is on managing spending, and allocating your limited money for different priorities. But there's also another way to bring your budget into balance. Money is fungible , which means that all money is the same...a $20 is a $20. You can take it a step further that earning an extra $20 is financially identical to spending $20 more. To your bank account, it's all the same.

Why does that matter to you?

Because it means that cutting spending isn't the only way to work through your budget. The second weapon in your arsenal is earning more.

Luckily, that does't always mean getting a second job, though that's the nuclear option if your budget is way out of balance and your spending obligations are just too difficult to push down to a level you can afford. If your required expenses (like rent, insurance, and groceries) are so high that you have a hard time keeping up with them, earning more may be your only option.

Asking for more hours, working overtime, and negotiating a pay raise are possibilities. Picking up a part-time gig job like Uber or Doordash can also bring in some extra cash, on your own terms, with little or no commitment on your part. Uber drivers earn an average of $15-$25 per hour, so driving for 10 hours on a weekend can earn you an extra $150-$250.

There are even solid options to help you earn money on the side without leaving your couch. You can earn an extra $100-$200 a month by doing simple tasks online, like surveys, transcription, and even scoring standarized tests. You may have to qualify, and it takes quite a few of these tasks to move the needle for real money. But the upshot is that they're usually quick and easy to do. If you're interested in learning more, check out this post.

Question 10: What should I do with excess money from last month?

What?? Extra money?

Sounds like a good problem to have, right? And turns out that when it happens, you should celebrate it. There's a reason for that, beyond just treating yourself to a good time because that's what you wanted to do all month to begin with.

Here's why:

Positive reinforcement. It doesn't just work for kids and dogs. It works for everyone. Our brains are chemically wired to associate a reward with the behavior that happened before it. So by celebrating, you're training your brain and building connections between success with your money and rewards, and making those wiser decisions easier and easier to make in the future. And eventually, automatic.

What should you do with that bonus money?

The first time it happens, treat yourself. Maybe the second time also. We already talked about why. But at some point, you'll want to start shifting that money to productive uses. And that's where budgeting really starts to pay off. What you should do with it depends on your goals and situation. But here are a few ideas:

- Start building an emergency fund

- Pay off high-interest debt

- Pay off lower-interest debt

- Start saving for your goals

- Put your money to work with interest-paying accounts or CDs

The road to financial security

Answering these budget questions truthfully is the first step to a successful budget and future financial security. Sticking to your guns and saving money is challenging, but your efforts will pay off for years. Pick the right budget for your lifestyle and personality, be stubborn about sticking to it, and work through any questions you have thoughtfully and honestly. The simple stuff will take you a long way.

If you're interested in more insightful questions about money, and want to learn a little more about yourself and your natural strengths and weaknesses, check out the Money Persona Quiz. It only takes 5 minutes and gives you solid insight and advice on approaching money, based on your own personality. Plus it's totally free.

Video coming soon...

Share this post

There are no comments yet.

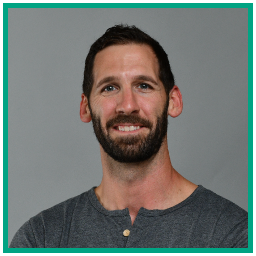

Pete Zimmerman

I've worked in financial services for more than a decade, and know where all the bodies are buried (and where the motivations are). I'm a Certified Financial Planner® and a licensed real estate broker, and love using what I've learned to simplify financial concepts and bring them to life in the real world, for working-class people like you.

Interested in more money ideas and solutions for your life?

Join Cashbasic's mailing list today and get exclusive content and offers direct to your inbox.

Social Connections

Special Thanks

Get Cashbasic's very best content (and exclusive offers) direct to your inbox.

No spam, ever. And we never share or sell your information.